By Marc Jones

LONDON (Reuters) – Higher stock markets showed the bulls were still firmly in charge on Thursday as the European Central Bank and Bank of England followed the U.S. Federal Reserve in extending one of fastest rise in global interest rates on record.

Despite the harmony of hikes, traders were holding on to the view that slowing economies would probably lead the heavyweights in the central banking ring to rein in the punches.

Fed chair Jerome Powell’s message on Wednesday after its quarer point hike that a “disinflationary” process was taking hold kept both European shares and Wall Street pointing higher [.N], and the dollar near a 10-month low. [.EU][/FRX]

The BoE’s policymakers had then raised Britain’s rates by 50 basis points with a thumping 7-2 majority. The ECB matched the move and signalled it would be another 50 bps next month too.

The usual post-decision action was lacking as the euro barely moved at just under $1.10.

The pound was a groggy 0.5% lower after the BoE raise, although the parallel drop in bond market borrowing costs left the gap between U.S. and German 10-year yields at its smallest since September 2020. [GVD/EUR]

“After the Fed and BoE both hinted at being close to the peak in their cycles, today’s meeting suggests the ECB are comfortable that they are also close to the end of their monetary tightening,” said Steve Ryder, a senior portfolio manager at Aviva Investors.

Away from the central bank action, there was more drama in India as one of its biggest firms, Adani Group, was forced the axe a long-planned $2.5 billion stock offer in the wake of allegations, denied by the firm, of hidden debt and stock manipulation.

Its flagship firm Adani Enterprises plunged 10% on Thursday, taking the wider group’s overall losses since the scandal erupted to more than $100 billion.

Elsewhere, though it did not derail the optimism that slowing, stopping and eventually lower interest rates in major economies will avoid a major economic slowdown.

MSCI’s broadest index of global shares, which covers 47 countries was up 0.25 having just hit a near six-month high.

Nasdaq futures were up 1.3%, thanks to an additional boost of a $40 billion Meta share buyback plan announced after-hours in the previous session, which was lifting tech stocks elsewhere. [.N]

Asia-Pacific shares where some of the biggest microchip makers and Chinese internet giants are listed closed up 0.2%.

That index is now up nearly 30% since October, helped heavily by China abandoning many of its COVID-19 restrictions.

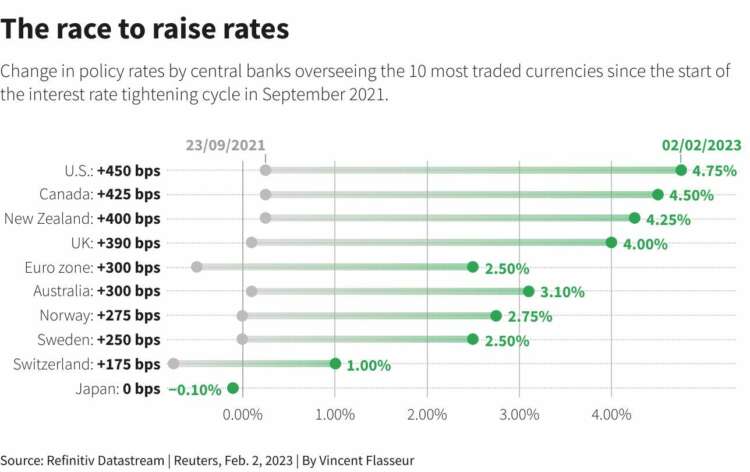

GRAPHIC: The race to raise rates (https://www.reuters.com/graphics/CANADA-CENBANK/dwvkdeaqopm/chart.png)

BOE, ECB & EARNINGS

The Fed’s 25 basis points interest rate increase on Wednesday came after a year of larger hikes. Though its statement said policymakers expected “ongoing increases” going forward traders leapt on Powell’s “disinflationary” view. [.N]

Ali Hassan, portfolio manager and managing director at Thornburg Investment Management, said Powell had also seemingly shrugged off easing financial conditions as a concern in his news conference.

“This was a green light that the market could buy without feeling that they are fighting the Fed,” he said.

Jamie Niven, a Senior Fund Manager at Candriam, said the BoE might now make only one more hike after its 10th in a row took UK rates to 4% or maybe even none if global growth splutters again.

Abrdn’s deputy chief economist Paul Diggle said the ECB, which also laid out a 15 billion euro-a-month “quantitative tightening” plan, had added a deliberate dash of caution by not pre-committing to any further rate rises beyond next month.

U.S. earnings season is in full swing too. Facebook owner Meta was set to surge after its after-hours buyback news, while internet giants Apple and Amazon are also due to report later.

In the currency market, the dollar buckled following Powell’s remarks on Wednesday but was little changed at 101.50 as U.S. trading started gathering momentum.

The euro was in ECB wait mode at, the yen was stalled at 128.97 per dollar, while sterling was down below $1.23 having been above 1.24 earlier in the week.

In commodities, oil steadied, having climbed on the back the soft dollar, while gold added 0.2% to $1,953.44 an ounce, having touched a nine-month high of $1,957 per ounce earlier.

Brent was at $82.23, down 0.75% on the day, while West Texas Intermediate (WTI) U.S. crude sat at $75.93 per barrel. [O/R]

(Additional reporting by Ankur Banerjee in Singapore; Editing by Mark Potter and Arun Koyyur)