Customer complaints are inevitable in financial services as some of the processes are often complicated. These complaints are frustrating to both customers and your team, and they can easily get out of control if left unchecked. The good news? Customer journey mapping can help reduce most of these complaints as you can identify and solve them before they become big issues.

In this article, we’ll explain what customer mapping is and look at how it can help keep your customers and staff happy.

What is Customer Journey Mapping in Financial Services?

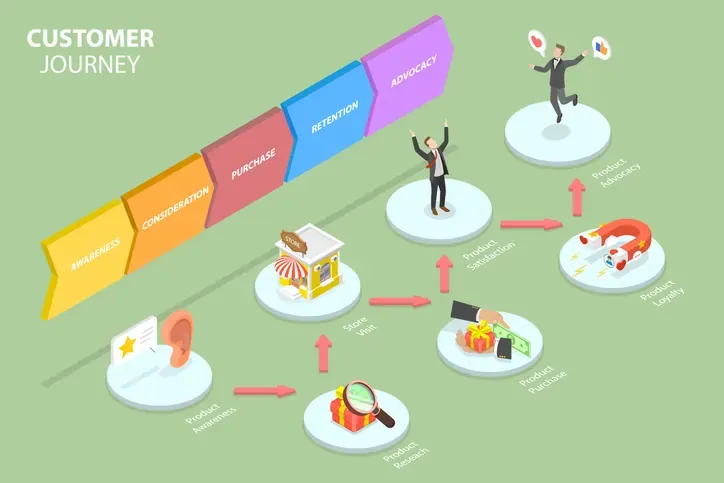

Customer journey mapping is the process of visualizing and analyzing the various steps a customer takes when interacting with your financial services. This includes every touchpoint, whether physical or digital, from when they discover your service to when they fill in a survey, if there’s any.

However, it isn’t just about listing the various actions. It’s about understanding the emotions, thoughts, and potential frustrations of the customer at each stage. This can then help identify pain points you can use to make informed improvements that enhance overall customer service.

How Journey Mapping Reduces Complaints

Customer journey mapping helps reduce customer complaints in several ways.

Identifying Pain Points Early

When you map out the customer journey, you get a clear view of the main issues that your customers experience. Is the process too lengthy, or are the instructions unclear? You can identify the main issues customers encounter based on the time taken in each phase as well as the specific complaints about the process.

For example, if most customers tend to abandon a loan application process at a specific stage, it may most likely need addressing. You can direct your attention there and improve the process.

Cutting Down on Redundancy

Customers tend to become easily frustrated when a process is tedious, especially due to redundancy. For example, do customers have to submit income documents during pre-approval and final approval stages? Journey mapping puts you into the customer’s shoes and helps identify and eliminate any unnecessary steps.

This not only streamlines the customer’s process but also boosts efficiency within your organization. Your team can focus on providing exceptional services instead of managing repetitive tasks.

Anticipating Customer Emotions

Customers usually go through varied emotions when dealing with financial services. For example, they can be excited yet anxious about a loan approval. Journey mapping helps organizations gain invaluable insights into the emotional highs and lows of each touchpoint.

From there, you can tailor your approach to create a more supportive environment. If approval takes time, you can communicate with your customers throughout the process. If the institution has denied their application, you can provide further assistance or offer reasons behind the decision. This will show you value their emotions and want to help them get a solution.

Engaging with Cross-Functional Teams

One of the best things about customer journey mapping is that you engage all teams, from marketing and sales to operations and customer support. This allows you to bring in diverse perspectives and insights that can enhance the customer experience. Each department interacts with customers at some point, and bringing those teams into one visualization will give you a unique and wholesome lens that reflects the customer journey at different phases.

For example, the marketing team will bring valuable data on customer preferences, while the sales team can offer insights into common questions and concerns. Customer support representatives will also help highlight recurring issues and frustrations.

The Payoff: Happier Customers, Fewer Complaints

When implemented effectively, customer journey mapping will help ensure everything runs smoothly. Customers will also feel more valued and have fewer complaints as you’ve improved the process based on customer feedback and data. At the same time, your team will benefit from a few complaint tickets and have more time to focus on delivering improved services. It’s a win-win for all parties involved.